×

Congratulations on your gig-selling journey with EmployeeZ! As you enjoy the excitement of sharing your talents and earning, it's important to understand your tax responsibilities. EmployeeZ is based in the United States, and gig sellers, whether in the U.S. or elsewhere, have specific tax obligations to the U.S. government. In this guide, we'll break down what you need to know about your tax obligations on EmployeeZ.

Form W-9: Certification of Tax ID Number

One of the key tax-related documents you'll encounter is Form W-9. This form is used by both U.S. individuals and entities to certify their Taxpayer Identification Number (TIN) or Social Security Number (SSN). When you sign up as a gig seller on EmployeeZ, you may be asked to complete a Form W-9 to provide your TIN or SSN. This information is essential for tax reporting purposes.

Form 1099-K: Annual Reporting

EmployeeZ takes tax reporting seriously. If you're a U.S. seller and you've earned gross payments that exceed $600 in one calendar year, you can expect to receive an annual Form 1099-K from EmployeeZ. This form reports the total amount of payments you've received through the platform during the year. It's an important document for tax filing, and you should keep it for your records.

Valid Tax Information

To ensure that you receive your Form 1099-K and comply with tax regulations, it's crucial to provide valid tax information when prompted. This includes accurate TIN or SSN details on your Form W-9. Keep in mind that failure to provide accurate and up-to-date tax information can lead to issues with tax reporting.

Seek Professional Advice

While EmployeeZ provides the necessary forms and reports to facilitate tax compliance, it's important to note that the platform cannot provide personalized tax advice. Tax laws can be complex and vary based on individual circumstances. Therefore, if you have questions or need guidance regarding your specific tax situation, we strongly recommend consulting with a qualified tax advisor or tax professional. They can provide you with tailored advice and ensure that you meet your tax obligations accurately and on time.

Your Tax Responsibility

Understanding and fulfilling your tax obligations is a crucial aspect of being a responsible gig seller on EmployeeZ. By providing accurate tax information and keeping records of your earnings and tax documents, you can navigate your tax responsibilities smoothly.

Remember, tax regulations may change over time, so staying informed and seeking professional advice when needed is the best way to ensure you're meeting your obligations.

In Summary

As you embark on your gig-selling journey on EmployeeZ, remember that tax compliance is an integral part of your responsibilities. Completing a Form W-9, receiving a Form 1099-K, and providing accurate tax information are all part of the process. If you have questions or concerns about your taxes, don't hesitate to consult a tax professional. With the right guidance, you can focus on what you do best—sharing your talents and earning on EmployeeZ.

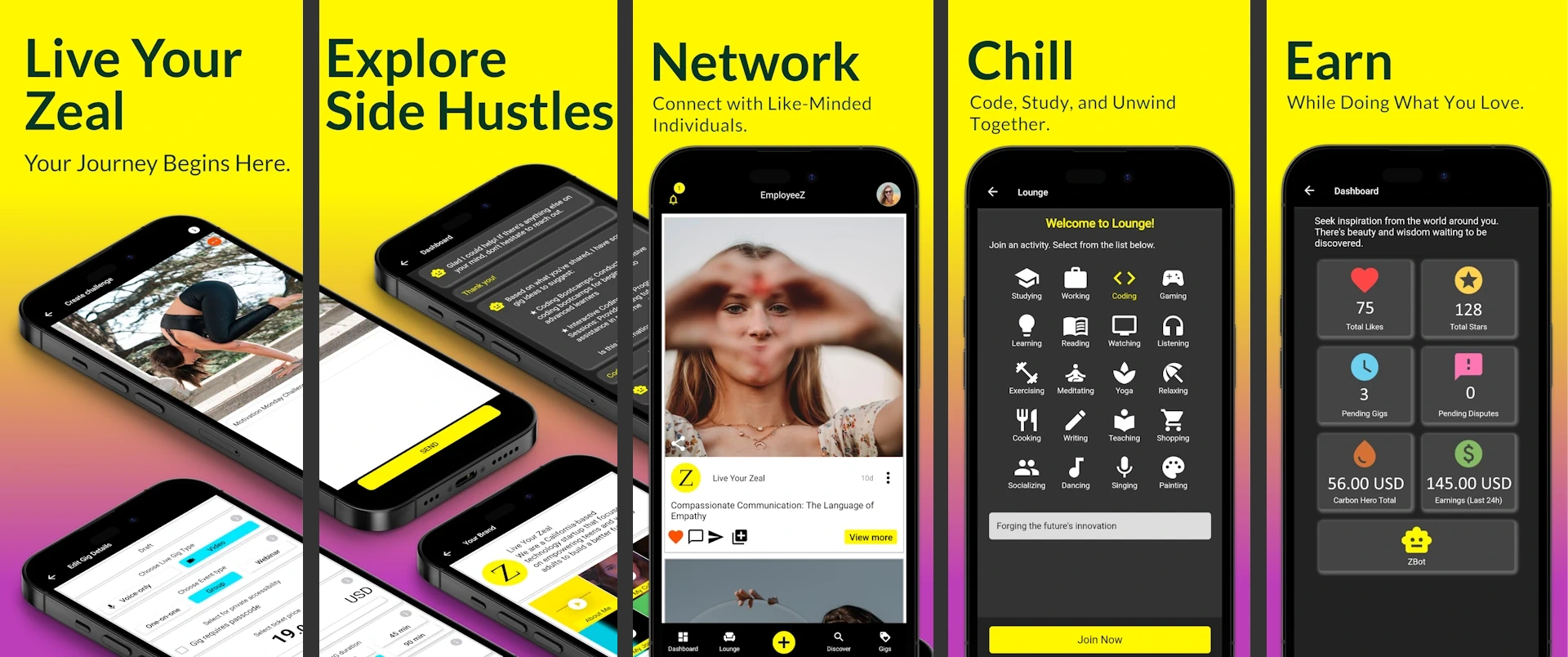

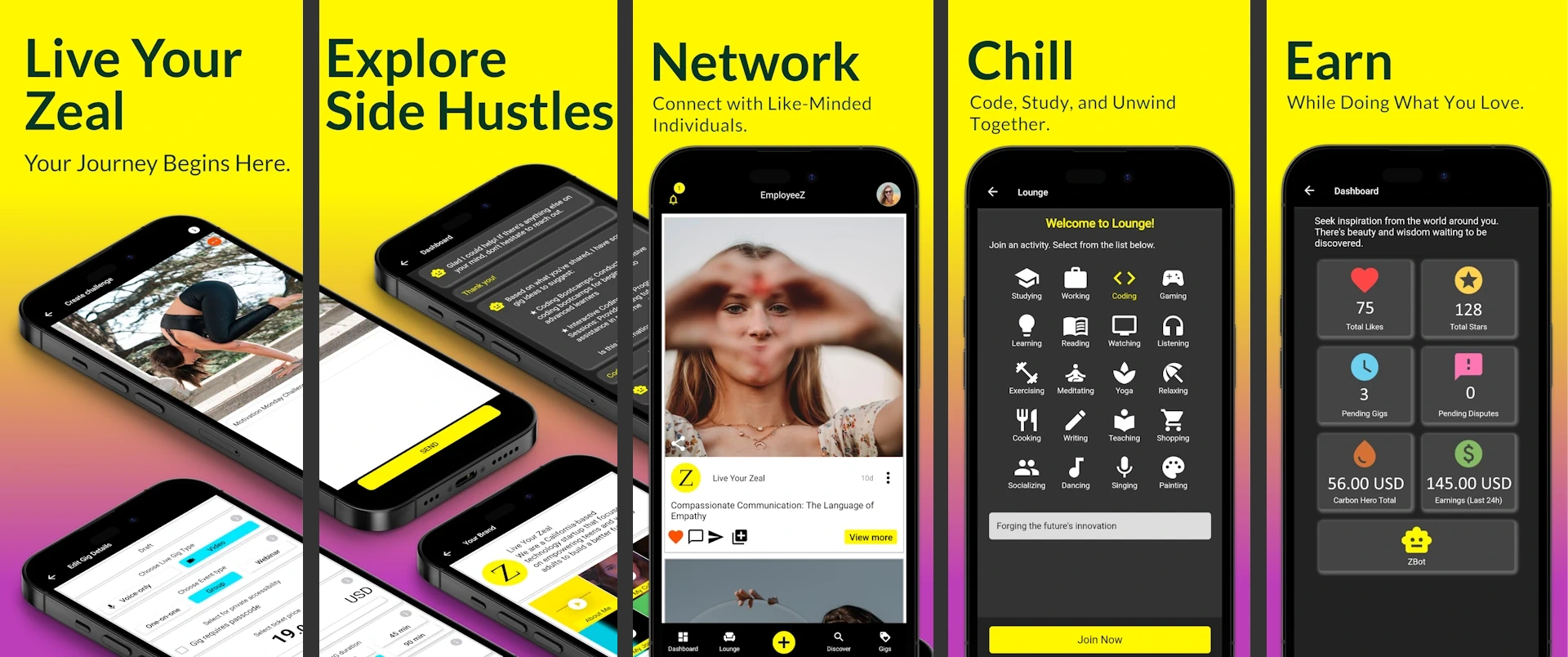

Join EmployeeZ for Free

Navigating Your Tax Obligations on EmployeeZ

Congratulations on your gig-selling journey with EmployeeZ! As you enjoy the excitement of sharing your talents and earning, it's important to understand your tax responsibilities. EmployeeZ is based in the United States, and gig sellers, whether in the U.S. or elsewhere, have specific tax obligations to the U.S. government. In this guide, we'll break down what you need to know about your tax obligations on EmployeeZ.

Form W-9: Certification of Tax ID Number

One of the key tax-related documents you'll encounter is Form W-9. This form is used by both U.S. individuals and entities to certify their Taxpayer Identification Number (TIN) or Social Security Number (SSN). When you sign up as a gig seller on EmployeeZ, you may be asked to complete a Form W-9 to provide your TIN or SSN. This information is essential for tax reporting purposes.

Form 1099-K: Annual Reporting

EmployeeZ takes tax reporting seriously. If you're a U.S. seller and you've earned gross payments that exceed $600 in one calendar year, you can expect to receive an annual Form 1099-K from EmployeeZ. This form reports the total amount of payments you've received through the platform during the year. It's an important document for tax filing, and you should keep it for your records.

Valid Tax Information

To ensure that you receive your Form 1099-K and comply with tax regulations, it's crucial to provide valid tax information when prompted. This includes accurate TIN or SSN details on your Form W-9. Keep in mind that failure to provide accurate and up-to-date tax information can lead to issues with tax reporting.

Seek Professional Advice

While EmployeeZ provides the necessary forms and reports to facilitate tax compliance, it's important to note that the platform cannot provide personalized tax advice. Tax laws can be complex and vary based on individual circumstances. Therefore, if you have questions or need guidance regarding your specific tax situation, we strongly recommend consulting with a qualified tax advisor or tax professional. They can provide you with tailored advice and ensure that you meet your tax obligations accurately and on time.

Your Tax Responsibility

Understanding and fulfilling your tax obligations is a crucial aspect of being a responsible gig seller on EmployeeZ. By providing accurate tax information and keeping records of your earnings and tax documents, you can navigate your tax responsibilities smoothly.

Remember, tax regulations may change over time, so staying informed and seeking professional advice when needed is the best way to ensure you're meeting your obligations.

In Summary

As you embark on your gig-selling journey on EmployeeZ, remember that tax compliance is an integral part of your responsibilities. Completing a Form W-9, receiving a Form 1099-K, and providing accurate tax information are all part of the process. If you have questions or concerns about your taxes, don't hesitate to consult a tax professional. With the right guidance, you can focus on what you do best—sharing your talents and earning on EmployeeZ.

EmployeeZ Inc.

16520 Bake Pkwy. Ste 230, Irvine, CA 92618, United States